No Stress or Giant Mess? A Blueprint for Open Enrollment Success

Written by: BIS Benefits

Download Our Free Open Enrollment Checklist

As a small business, managing open enrollment can often feel like juggling a myriad of tasks while trying to ensure everything goes off without a hitch. At BIS Benefits, we understand the challenges you face and are here to help streamline your open enrollment process. Whether you're looking to enhance your open enrollment planning or seeking comprehensive benefits enrollment software, we've got you covered.

The Importance of Proactive Open Enrollment Planning

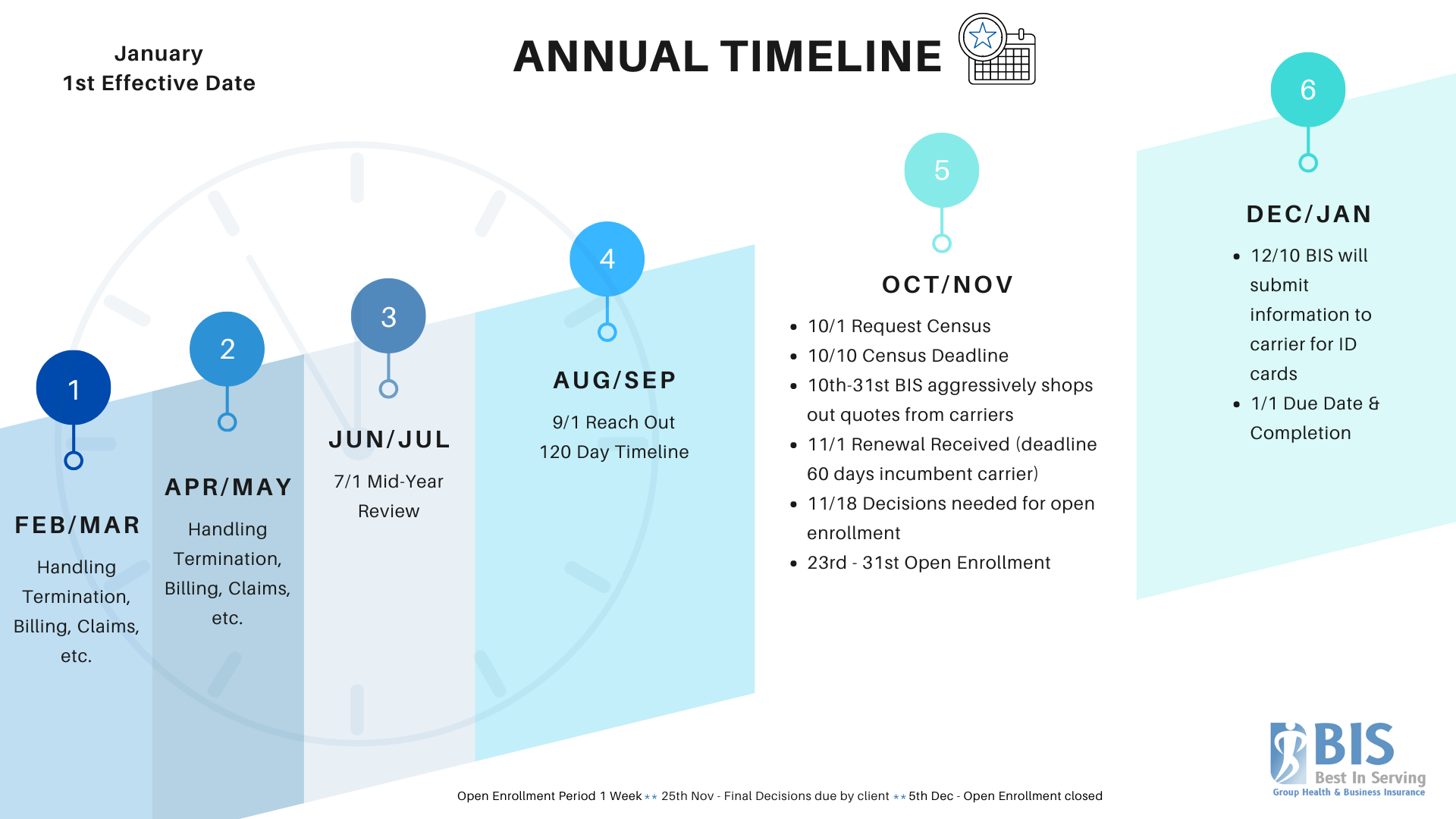

One of the key takeaways from our recent podcast discussion is the significance of proactive open enrollment planning. Imagine you're an HR manager or a small business owner preparing for a January 1st renewal. The last thing you want is to notify your employees about new benefits on Christmas Eve or struggle with late ID card distributions. Unfortunately, many businesses face these challenges due to poor planning.

To avoid these pitfalls, we recommend beginning your open enrollment planning as early as September. This early start gives you ample time to discuss your needs, evaluate different plans, and ensure that all changes are communicated effectively. For more detailed guidance, check out our blog on Proactive Open Enrollment Planning. Additionally, our Benefits Enrollment Software simplifies this process, ensuring timely and accurate implementation across all aspects of your benefits program.

Key Deadlines to Keep in Mind:

A successful open enrollment experience hinges on hitting key deadlines. For instance, if your renewal is on January 1st, you should be conducting your open enrollment meetings no later than the end of November. This means initiating discussions as early as September to ensure everything is in place. For those in industries such as Construction, meeting these deadlines is crucial due to the unique insurance needs and seasonal work schedules.

Our team at BIS Benefits puts a strong emphasis on collaboration. We work closely with our clients to set and meet these deadlines, ensuring that the open enrollment process is smooth and stress-free. By pushing for early decisions and maintaining open lines of communication, we can help you avoid the nightmare of last-minute changes and ensure that your employees are informed and satisfied.

Investing in the Right Open Enrollment Solutions

At BIS Benefits, we've made significant investments in open enrollment solutions, including top-tier benefits enrollment software. This technology allows us to manage the complexities of open enrollment efficiently, from updating contributions to managing payroll periods. Our software streamlines the process, ensuring that everything is documented and communicated clearly to your staff.

Why did we make this investment? Because we understand that time is of the essence, especially during open enrollment. By investing in advanced technology and a skilled team, we can provide you with a seamless experience that saves you time and minimizes errors. Our goal is to help you avoid the headaches that often come with open enrollment, allowing you to focus on what matters most—running your business.

If you’re also navigating COBRA compliance, our COBRA Administration services ensure that your benefits administration remains compliant and efficient.

Creating a Comprehensive Open Enrollment Planning Checklist

To further streamline your open enrollment process, consider developing a detailed open enrollment planning checklist. This checklist should include key milestones, such as setting deadlines for employee meetings, finalizing benefit selections, and ensuring all changes are communicated well in advance of the renewal date. A well-organized checklist can be your best ally in managing the complexities of open enrollment.

If you're looking for more tips on how to improve your open enrollment process or need help with benefits enrollment software, check out our comprehensive solutions.

Conclusion

Open enrollment doesn't have to be a stressful experience. By starting early, collaborating closely with your broker, and investing in the right tools, you can ensure a smooth and successful open enrollment for your business. At BIS Benefits, we're here to support you every step of the way, providing the expertise and technology needed to make your open enrollment a breeze.

This is part one of our series on open enrollment 2024. Click here to read part two.