Georgia Open Enrollment Checklist 2024

Written by: BIS Benefits

Georgia Open Enrollment Checklist for 2024: A Step-by-Step Guide

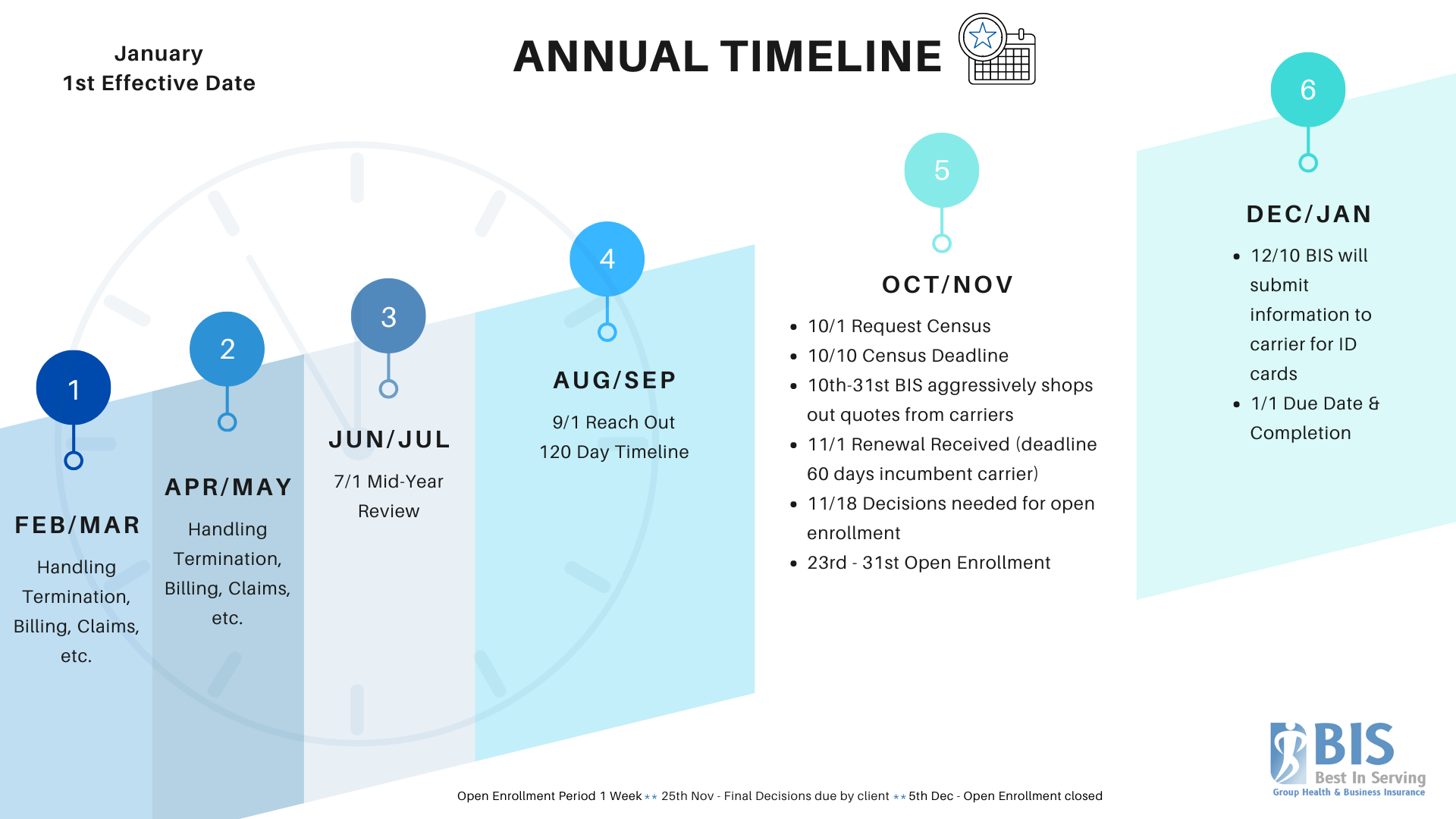

Open enrollment is an essential time for Georgia employers to review and finalize their employee benefits. Whether you are a small business in Roswell or a larger organization in Savannah, following a structured checklist can ensure a smooth and compliant enrollment process. Below is an open enrollment timeline, tailored to Georgia businesses, to help guide your preparations from September through January. This is part two of our series on open enrollment 2024. Click here to read part one.

September: Laying the Groundwork

For effective open enrollment planning, start in September with initial discussions about goals and potential changes. This is the perfect time for small businesses to evaluate their currentgroup health insurance in Georgia. Consider whether your offerings align with your employees’ needs and your company’s budget. You might also explore addinggroup dental insurance orvision coverage to enhance your benefits package and attract top talent in the competitive Georgia job market.

Early October: Data Collection

As October begins, update your employee census and demographics. Accurate data is essential for open enrollment, ensuring you receive precise quotes from insurance carriers. Changes in your workforce can significantly impact your insurance rates, so having up-to-date information is critical.

Download Our Free Open Enrollment Checklist

Mid-October: Reaching Out to Carriers

By mid-October, send your updated information to insurance carriers. This timing allows them to prepare quotes and gives you ample opportunity to explore various options. If you’re considering a change, now is an excellent time to look into different business insurance options tailored for your industry.

First Week of November: Evaluation and Negotiation

At BIS Benefits, we've made significant investments in open enrollment solutions, including top-tier benefits enrollment software. This technology allows us to manage the complexities of open enrollment efficiently, from updating contributions to managing payroll periods. Our software streamlines the process, ensuring that everything is documented and communicated clearly to your staff.

Why did we make this investment? Because we understand that time is of the essence, especially during open enrollment. By investing in advanced technology and a skilled team, we can provide you with a seamless experience that saves you time and minimizes errors. Our goal is to help you avoid the headaches that often come with open enrollment, allowing you to focus on what matters most—running your business.

If you’re also navigating COBRA compliance, our COBRA Administration services ensure that your benefits administration remains compliant and efficient.

Mid to Late November: Finalizing Decisions

By mid to late November, it’s time to finalize decisions and prepare for employee communication. Utilizing comprehensivebenefits enrollment software can streamline this process for small businesses, making it easier to manage plan selections and employee data.

End of November/Early December: Employee Education

The final step in the open enrollment timeline is holding informative meetings with employees. These sessions should address any changes in coverage and answer questions. It’s also an excellent opportunity to educate your staff on the value of their benefits package and how to maximize their coverage.

By following this open enrollment planning timeline, Georgia small businesses can ensure a smooth process that benefits both the company and its employees. Proper planning and communication are key to a successful open enrollment.

At BIS Benefits, we’re committed to helping businesses navigate the complexities of employee benefits. Whether you’re looking forworkers’ compensation insurance or need assistance withCOBRA administration, our team is here to support you every step of the way.

Don’t let open enrollment overwhelm your business. Start your planning early, stay organized, and don’t hesitate to seek expert advice from local professionals who understand the unique landscape of Georgia’s insurance market. Your employees—and your business—will thank you for a well-executed open enrollment process.

To hear our entire conversation about having the best open enrollment period ever, watch the podcast here:

This is part two of our series on open enrollment 2024. Click here to read part one.